Elizabeth Warren on "Fresh Air"

Here are some things I heard on "Fresh Air" tonight. You can download the program from Audible.com and here's a previous interview with Elizabeth Warren on the same subject: the rapacious practices of credit card companies. I bolded a few of the choicest bits.

- Credit card companies sent out 8 billion pre-approved card applications last year.

- The preferred customers are not those who pay their bill on time each month - if you pay your bill in full the companies refer to you as a "deadbeat." The customers the companies lust for are the shaky customers - those who will carry a balance and miss payments from time to time. "Miss a couple payments and see how many more offers you get."

- According to the language on their agreements, credit card companies can change the interest rate they charge you at any time for any reason.

- Though the companies make a small profit on every transaction, the true generator of income is the "extra $49 here and there" they hit customers with. In most cases these obscure fees won't make you mad enough to cancel the card.

- The companies sometimes impose fees for no reason. This year, one company one hit everybody with a $75 fee. Anybody who complained got the fee removed from their bill. This way, the company kept their "alert, cranky customers" and got $75 from the careless and timid.

- Terry commented about late fees: "There isn't a lot of time to pay before your time is up!" Warren revealed this trick: for six months your bill will be due on a certain date, then without notice the date will be moved several days earlier. "Many more people will get it wrong and think it's their fault."

- Another trick: people on the east coast receive pre-printed envelopes directing their payments to some town on the west coast - a small town is chosen because it takes longer for mail to make it out of a major metropolitcan area. But west coast customers mail their checks to a small town on the east coast!

- "There are multiple allegations that some companies delay opening bills, and even shred them!" It's all to get late fees. Some customers will complain but most have too much else going on and won't notice, or can't bear the agony of trying to fix the situation.

- Terry Gross: "I had [an unjustified charge]. I complained three months in a row. They said they'd take it off, but each month it was back again."

Elizabeth Warren: "Realize you are up against an entire army of MBAs whose job is to do nothing but figure out how to maximize profits and pick your pocket. If leaving you on hold for 9 minutes means half the callers give up and pay rather than wait longer, that's the point. ... These errors are not unintentional - all the mistakes all run in one direction, towards the companies..." - Warren conducted an experiment with a class comprising 80 third year Harvard Law School students, just a couple months from graduation. One of her students had brought in a credit card offer trumpeting 3% cash back and asked "Surely even you must admit this is a good deal."

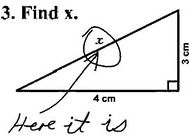

She xeroxed the offer passed it out to her bankruptcy class and asked two questions: What's the effective interest rate, and under what circumstances will you get the 3% cash back?

"It took the entire group, the eighty law students in my bankruptcy class, working together for an entire hour, to figure out they THOUGHT it was a 17.99 percent card, and that you only got cash back when you were paying that rate - that is to say, it was a 14.999% card. It took an hour for them to figure that out. What chance does the ordinary customer have to understand these terms?" - Terry Gross asked if there exists a way to find out how long it will take you to pay off your debt if you pay the minimum each month. "The companies hope you don't find out. They have fought legislation in Washington and some states that would require that piece of information - the addition of one simple line on your bill that says "if you make the minimum payments it will take you ... to pay off your debt."

She gave this example: if a young couple charges $5,000 worth of baby supplies and pays the minimum, the baby will be grown, married, and have babies of his/her own before the debt is paid off - 34 years. - Since Colonial days, the U.S. had usury laws - there was a maximum legal interest rate. If you charged a higher rate it was called loan sharking and you could go to jail.

This changed in 1979. The question before the Supreme Court: if a bank is in Montana and the customer is in California, which state law is in effect? Most people thought it should be the law in the customer's state - you'd be protected by your own state laws. But the court said Congress intended the state where the bank is incorporated to have precedence. "South Dakota says - hmm, jobs, clean industry, and most people with credit cards don't live here - and it repealed its usury laws. And Citibank moved there and issued cards all over country, circumventing all the usury laws. Delaware said 'me too.' And the usury laws died." - The new tougher bankruptcy law has emboldened the banks, since it makes it harder for customers to get out from under. Credit card companies increase pre-approved mailings 30% between 2005 (before the new law) and 2006. "They're looking harder for more customers, particularly shaky customers. They're pushing harder with tricks-and-traps pricing... They pushed for this law, - it was in fact drafted by their lobbyists."

The credit card lobby is #1 or among the top 3 givers of campaign contributions every year. "Each congressman and senator got 2-3 personal calls a day every day, month after month, emphasizing how important it was for senator x to vote right on bankruptcy." - Americans carry more debt than ever before. 36% are worried they can't pay their credit card bills. 40% have missed at least one payment in the last 2 years. 25% of American families are maxed out on at least one card. 1 in 7 Americans today is being hassled by a debt collector because of missed payments.

Warren blames two things: First, debt is more heavily marketed - we don't see ads for saving money, putting it aside for a rainy day. Hundreds of millions of dollares are spent on ads to get you to take on more debt. Second: families are under more economic pressure. Within the last generation, median wages for fully employed males are flat while expenses (for housing and health care for instance) have gone up by 70% in inflation adjusted dollars.

Technorati Tags: Debt, Credit+Cards

A few of my daughter

Melina's great posts:

A few of my daughter

Melina's great posts:

3 Comments:

I heard this interview a few hours ago. Thanks for posting. Now the hard question: should a high school graduate be able to read a credit card agreement? That is, given the tactics of credit card companies, does high school now need to be the equivalent of three years at Harvard Law School?

I was recently at dinner with a guy who worked for American Express. He claimed that Amex's practices were more honest - rather than making most of their money from your carrying a balance, they make most of their money in upfront (and large) annual fees they charge for the privilege of the use of the card. They don't care as much if you carry a balance (he says) because their money really comes from these fees. They also charge businesses three times as much as Mastercard and Visa charge for the ability to accept customers' Amex.

They also make an incredible ton of money off "gift cards" - you pay Amex about $105 to give someone $100 on a precharged Amex card. So Amex just made five dollars for free. They're also pocketing the interest that the $100 is earning before the recipient spends it - and this is the main source of revenue for the gift card, though they ALSO charge a "maintenance" fee of a couple bucks each year if you don't use the card.

Interestingly, they *don't* make a lot of money off the unused balance itself, if you just leave it in a drawer forever, because it counts as abandoned property and technically reverts to the state.

I try to be a "deadbeat" as much as possible. If I miscalculate spending and have to carry a balance, I'll do it on my AmEx for a few days, then pay off in full.

Why? Because AmEx really cares about service. Just try to use the apparently "same" warranty extension program on Visa and AmEx. Or see if a Visa/MC rep will offer you advice that actually benefits you. With AmEx I not only get passed to the next department without holding, but the rep makes sure I don't have to repeat stuff to the next person handling my case. Props to AmEx.

So why don't I use AmEx exclusively? The Visa/MC reward programs are nice especially the cashback with amazon.com and other things. I have multiple cards and I use them wisely. If you pay online and watch your bills and do all that stuff they DON'T expect you to do, you can ride along and collect some nice freebies.

But, it does cost you vigilance stress, which becomes normal over time - you don't typically run into cars while driving do you?

One big benefit of using credit to purchase is the warranty extension program. I've used mine and it's definitely been worth the risk of having to tread carefully with payments. And the way AmEx handled my case, I would readily buy more things with their card over Visa/MC.

What about Discover? Scum of the earth. They make Visa/MC look honest.

I have no affiliation with any of the cc companies. This is strictly from personal experience.

Post a Comment

<< Home